Buying a home is a significant milestone for any couple, and it holds even more significance for newlyweds. It marks the beginning of a new chapter, where they can build a life together and create a place they can truly call their own. However, the process of purchasing a home can be both exciting and challenging, requiring careful planning and decision-making.

In this article, we will explore the essential steps and considerations for buying a home as newlyweds, helping you navigate this journey and make informed choices.

Assessing Your Needs and Budget

Before diving into the home-buying process, it’s important to have a clear understanding of your needs and budget. As newlyweds, discuss your housing preferences and priorities. Consider factors such as the desired location, size of the home, number of bedrooms, and any specific features or amenities that are important to both of you.

Aside from that, determine a realistic budget by evaluating your combined income, existing debts, and future financial goals. Don’t forget to include additional costs such as home maintenance, repairs, and insurance. Having a well-defined budget will help narrow your search and guide your decisions.

Researching the Housing Market

Once you have a clear idea of your needs and budget, it’s time to research the housing market. Explore different neighborhoods and locations that align with your preferences. Pay attention to market trends, property values, and potential growth in the areas you are considering. This research will help you make informed decisions and narrow down your options.

Finding the Right Real Estate Agent

Working with a reliable and experienced real estate agent can make the home-buying process smoother and more efficient. Seek recommendations from friends, family, or colleagues, and interview potential agents to ensure they understand your needs and have a track record of success. A good agent will guide you through the entire process, from house hunting to closing the deal.

Home Viewing and Selection

Once you have a real estate agent on board, you can start viewing potential homes. During this stage, prioritize your must-haves and deal-breakers. Take note of the layout, condition, and overall appeal of each property. It’s also essential to consider the long-term aspects, such as the potential for future growth and the suitability of the home for your evolving needs.

The Offer and Negotiation Process

When you find a home that meets your requirements, it’s time to make an offer. Your real estate agent will assist you in determining a competitive offer price based on market conditions and comparable sales. Be prepared for negotiation and counteroffers from the seller. Balancing your desires with a realistic negotiation strategy will help you secure a fair deal.

Securing Financing and Completing Paperwork

Securing financing is a critical step in the home-buying process. Explore mortgage options and get pre-approved to have a clear understanding of your borrowing capacity. Work closely with your mortgage lender to gather all the necessary documents and complete the paperwork accurately. Be prepared for additional costs such as closing fees, inspection fees, and potential repairs.

Home Inspections and Closing Procedures

Home inspections are vital to ensure that the property is in good condition and free from any major issues. Hire a professional inspector to thoroughly assess the home’s structural integrity, electrical systems, plumbing, and other crucial aspects. If any concerns arise, negotiate repairs or request seller concessions before proceeding with the closing procedures.

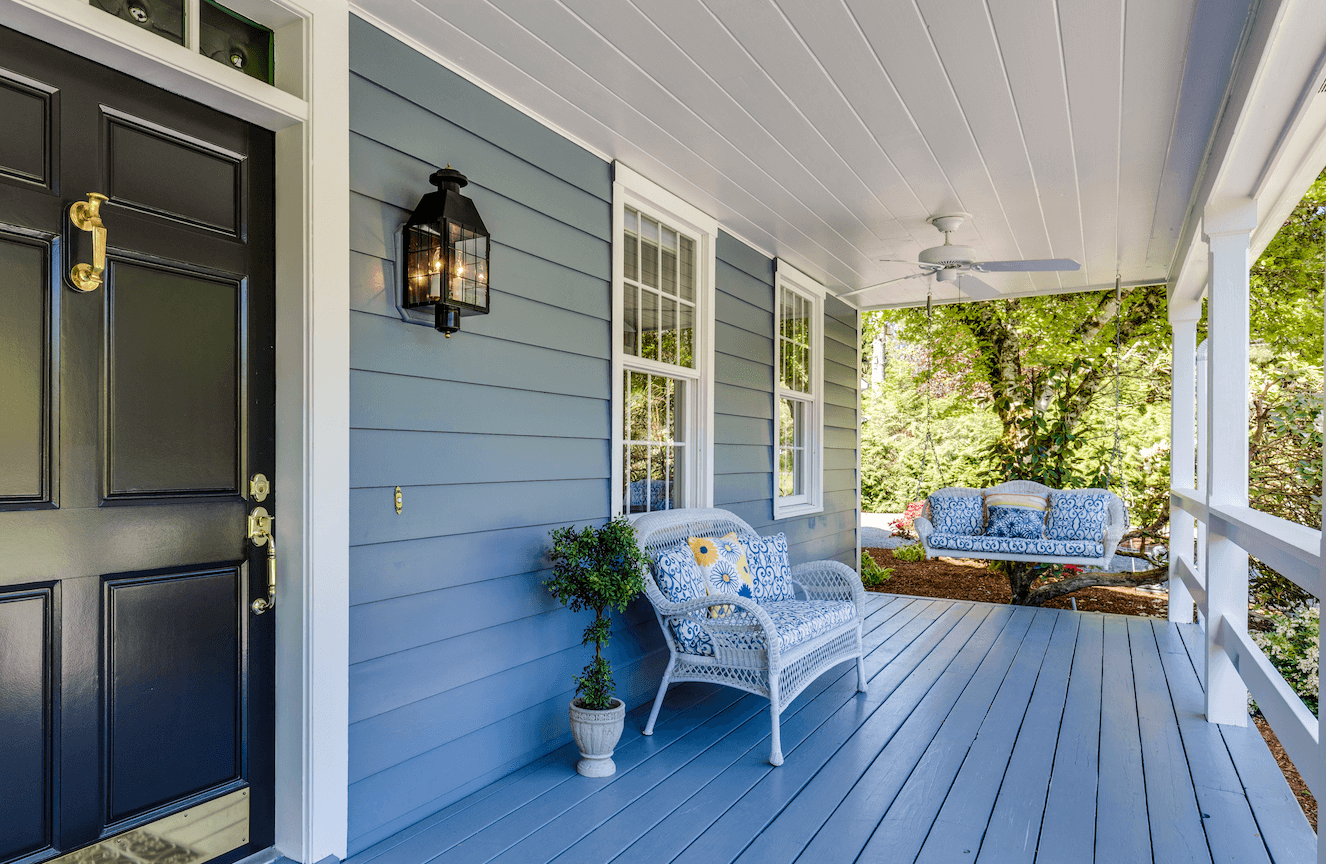

Making Your New House A Home

Once the closing is complete, it’s time to move into your new home and make it your own. Take the opportunity to personalize your space, decorate according to your style, and create a warm and inviting atmosphere. Set a budget for furnishing and prioritize the essentials first, gradually adding personal touches over time.

Building A Strong Financial Foundation

Homeownership brings new financial responsibilities. Manage your expenses wisely by creating a budget that considers mortgage payments, utilities, insurance, and maintenance costs. Additionally, focus on building a strong financial foundation by saving for emergencies, planning for future goals, and considering long-term investments.

Now that you have taken the necessary steps in the home-buying process, it’s time to enjoy your new residence. With careful planning and informed decisions, you can ensure a successful purchase that will provide years of comfort and financial security.

The post Starting a Home, Starting a Life: Buying a Home as Newlyweds appeared first on Enterprise Podcast Network – EPN.

Leave a Reply